Six months into Subway replacing its pre-sliced meats with freshly sliced servings, one of the chain’s largest franchisee groups says that sales are duller than expected.

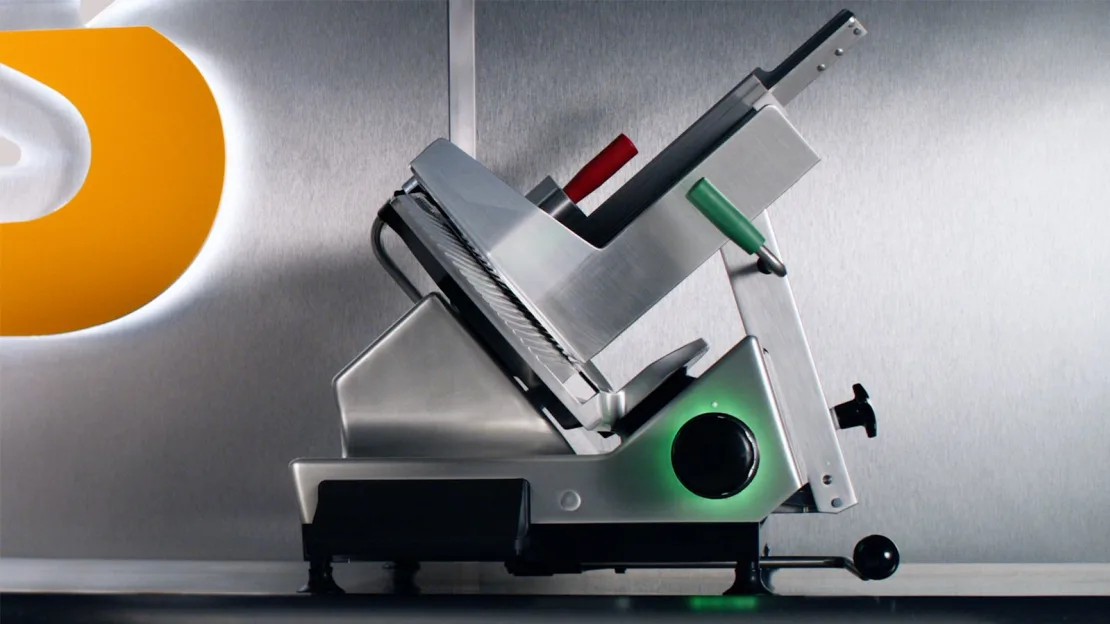

Last year, Subway paid to install $6,000 slicers at the chain’s 20,000 US locations in response to its rivals serving freshly sliced meat. It was an attempt to ignite sales at the nearly 60-year-old chain, which have been sagging compared to its fast-growing competitors.

The results, so far, have been a “mixed bag,” according to Bill Mathis, the chairman of the North American Association of Subway Franchisees (NAASF), which represents as many as half of Subway locations on the continent.

“We haven’t seen any data that says these slicers have driven sales, driven customer counts or profitability,” Mathis said about the slicers on a recently released podcast for Restaurant Business, a trade publication. “The bottom line here is that nobody is saying this is the greatest thing, if I may say, since sliced bread or since sliced meats.”

Some restaurants are “struggling with it, but not everybody,” Mathis said of the initial response he’s hearing from NAASF members. One issue is that labor has increased, notably from often cleaning the slicer, because it “takes a little bit more time to slice it than it does how we did it before.”

Franchisees, so far, also haven’t seen the benefits of lower food costs. The company has said pre-sliced meat delivered is more expensive compared to freshly sliced meats.

Mathis said the “waste factor” wasn’t accounted for from corporate and that he’s heard that some restaurants are disposing as much as six ounces a day to “wasting pounds in a week,” all of which add up in an industry with razor-thin margins.

Compared to a year ago “we were taking it out of packages that would come to us and the labor involved there is really nothing and the waste is little to nothing literally,” he said.

Freshly sliced meat was a cornerstone of Subway’s “Eat Fresh, Refresh” campaign that also includes store remodels, new side dishes and a revamped menu that added new sandwiches highlighting the slicer’s capabilities.

In Mathis’ view, customers are apathetic about the slicers. He said there’s “no data on what the consumer perception is on this or how they react to it, but just listening to our members, it’s really a mixed bag where some people really don’t care. It really doesn’t matter to them.”

“To a few people saying, you know, you’re trying to be somebody else, another competitor, but you’re really not there. So nice try,” he said. Subway didn’t immediately respond for comment.

Franchisee’s flaring tensions

The candor expressed by Mathis isn’t the first time franchisees have expressed their frustration with Subway. Some franchise operators complained publicly about the company’s treatment of them.

In 2021, an anonymous group of “concerned franchisees” wrote an open letter to Elisabeth DeLuca, a co-owner of the chain. The Subway dream “has turned into a nightmare,” they said, writing that Subway hurt their business by franchising new locations nearby or shutting down stores for minor infractions, among other things.

In a separate letter, they complained of high franchise fees. Subway’s franchise fees are “competitive,” a former company executive previously told CNN.

Subway, a privately held company, highlights praise from some franchisees during its periodic financial releases. In 2022, a release featured a quote from Donna Curry, a Subway franchisee that owns about 65 locations.

“We are hearing from guests that they like the flexibility of ordering by name and number and are enjoying the new Subway Series sandwiches, which is reflected in the increased traffic and sales across my restaurants,” she said about the company’s positive quarter.

In the podcast, Mathis said there’s been “some disagreements on some things” between NAASF and Subway, but praised other changes implemented by CEO John Chidsey, including its athlete-studded advertising and Subway Series menu.